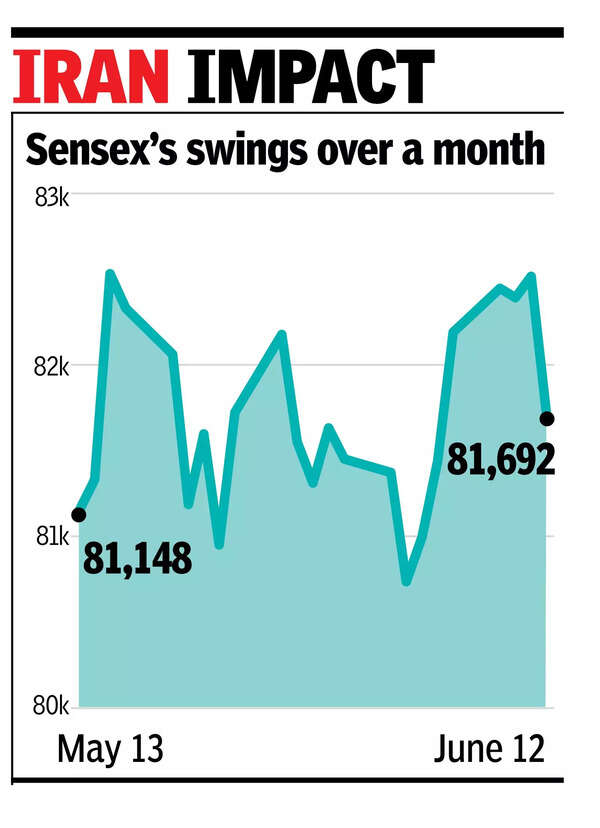

MUMBAI: Geopolitical factors, primarily talks of an imminent Israel attack on Iran, left global investors jittery, impacting those on Dalal Street on Thursday. As a result, the Sensex closed 823 points down at 81,692 points, with L&T, Infosysand ICICI Bank contributing the most to the index’s loss for the day.The day’s session also left investors poorer by nearly Rs 6 lakh crore, with BSE’s market capitalisation now at Rs 449.6 lakh crore, official data showed. Tariff-related uncertainties and rising crude oil prices also weighed on investors, market players said. On the NSENifty closed 253 points lower at 24,888 points.

According to Vinod Nair, head of research at Geojit Investments, consolidation in domestic markets is evolving into a broad-based trend, now extending to large-cap stocks. “Valuation concerns and rising oil prices, driven by West Asia tensions, are fuelling risk aversion among investors. Adding to the uncertainty, the US is considering unilateral tariff hikes on several key trading partners, with a decision expected within the next one to two weeks, ahead of an early July deadline.“In Thursday’s session, foreign funds were net sellers of stocks worth Rs 3,831 crore, while domestic funds were net buyers at Rs 9,394 crore, BSE data showed.