Mumbai/Bengaluru: RBI has ordered Simpl, a Bengaluru-based buy-now-pay-later (BNPL) firm, to shut its payments operations with immediate effect. The platform, which works with 26,000 merchants and lets shoppers defer payments at checkout, had been running a payments system without the central bank’s blessing. Under the Payment and Settlement Systems Act of 2007, no company can operate such a system without explicit authorisation.

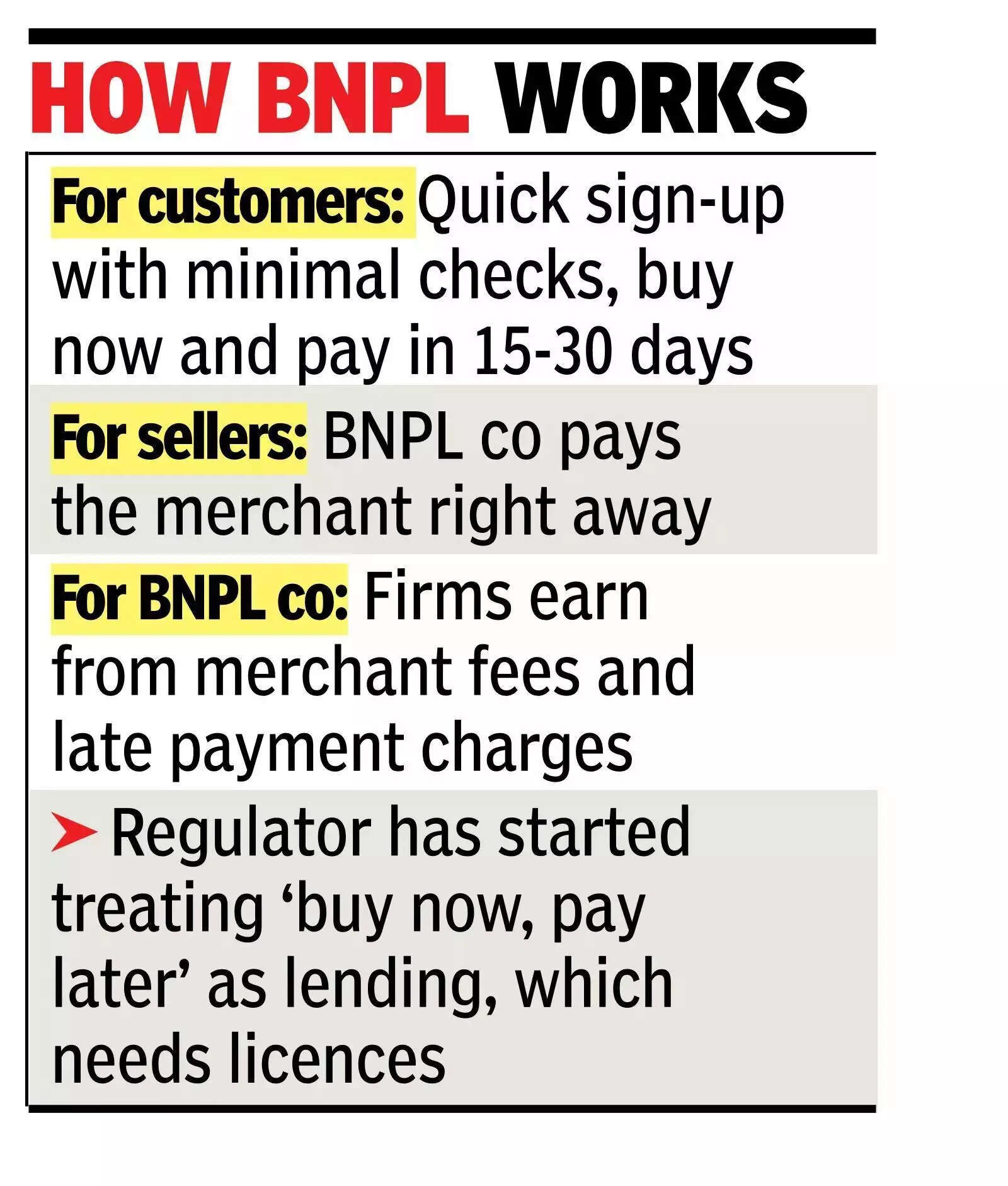

The order is the latest salvo in the RBI’s campaign to tame the fast-growing world of digital credit. BNPL schemes have proliferated in recent years, enticing consumers with instant credit lines and merchants with seamless sales. According to industry sources, the regulator’s concerns are around unsecured lending, weak oversight and poor consumer safeguards. In 2022 the RBI stopped BNPL firms from topping up prepaid payment instruments with borrowed money-a ruling that pushed them closer to the digital-lending rulebook.Simpl’s fate echoes another crackdown last year, when card networks were rapped for running business-to-business payment flows through third parties lacking approval. In both cases the offence was the same: conducting clearing and settlement without a licence. The difference is that the card networks case concerned corporate card flows, whereas Simpl’s involves consumer credit and payment aggregation. The RBI’s message is plain: whether card-based or BNPL, all digital payment systems fall under its writ.Simpl, operated by One Sigma Technologies, had earlier come under Enforcement Directorate (ED) glare for alleged violations of India’s foreign direct investment (FDI) and foreign exchange rules. The allegation is that the company received Rs 913 crore by classifying its business as IT services, which qualifies for 100% automatic FDI approval. However, the agency determined that Simpl’s actual business model was financial services, requiring prior government approval which it did not obtain.A senior Simpl executive explained the firm’s approach, saying “we use our own money against our own collateral, no public money is involved. If a customer defaults, the loss is ours.” The person added that Simpl does not charge interest. “We earn a merchant fee and levy a flat late fee, so customers don’t enter an interest spiral,” he told TOI anonymously.