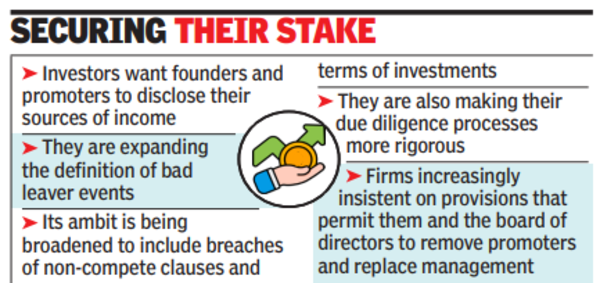

MUMBAI: Financial and corporate governance lapses at Gensol Engineering and its affiliate BluSmart have nudged investors to tighten the terms of investment contractsand incorporate additional clauses to protect their investments, lawyers told TOI. A series of frauds and governance mishaps at startups over recent years already made investors legally prudent, but now they are seeking more.For instance, they want founders and promoters to disclose their sources of income, said Maulin Salvi, leader, corporate governance practice at Nishith Desai Associates.

They are also expanding the definition of bad leaver events (circumstances in which a founder or key employee exits the company under unfavourable conditions) and making the due diligence process more rigorous. Earlier, only criminal complaints against founders were considered a bad leaver event, allowing investors to remove them from their positions. Now, its ambit is being broadened to include breaches of non-compete clauses and terms of investments.

“Following a series of lapses at startups, LPs (limited partners) are seeking more accountability from venture capital investors today. Many contracts are also coming with deferred payment options (funds which investors disburse to companies) rather than upfront payments,” said Salvi. Incidents like BluSmart prompted investors to re-evaluate downside protections in venture deals, said Winnie Shekhar, Partner at IndusLaw. Downside protection is a mechanism wherein investors put rules in place to protect their money. “We are seeing a clear shift towards tighter controls – liquidation preference stacking, veto rights on risky spends, and sharper monitoring covenants are becoming more common,” Shekhar said.

BluSmart, once seen as a competitor to Ola and Uber, has suspended operations after a regulatory probe revealed that Gensol promoters Anmol Singh Jaggi and Puneet Singh Jaggi diverted funds raised through loans for buying electric cars for BluSmart for personal expenses. Lenders to the companies are looking at all legal recourses to protect their money. Recently, another startup, Medikabazaar, removed its founder and former CEO Vivek Tiwari from the board over allegations of fraudulent activities.